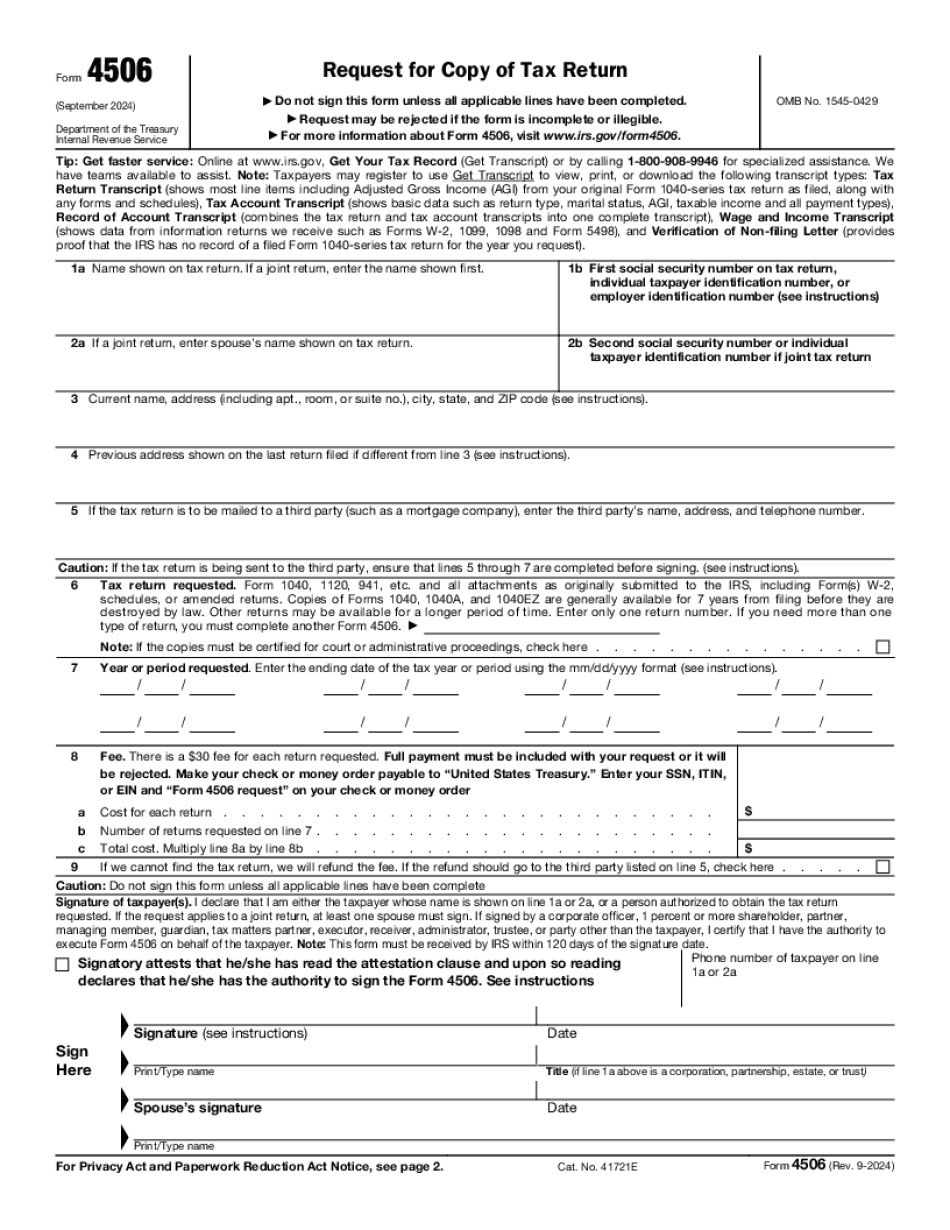

Did rely hi just another missus perished I need a graduate I'm not sure can you believe it's friday already it's been a longer weekend the mortgage industry but we've made it through yeah i have a lot couple of lunges the last day because the rates got worse but today we're actually pretty flat yeah as you can see the chart shows racer staying pretty much the same and from what we're hearing the experts are saying you have a loan closing in the next couple weeks go ahead and lock it if you're pushed out further than that just sit tight because right should stay wrote for the same yeah you know something interesting happen today i got question again and i get this question a lot why do i have to make my barber sign this form called the 40 50 60 Parrish you want explain that yeah I think better than me explaining it let's live this video speak for yourself it's amazing parish that all that went on just a few years ago it's still going on today very true very true and that's the form basically as a check to balances so the lender can pull your tax transcripts and it's comparable to exactly what you did file yeah they want to make sure that fake tax returns weren't putting to file and it's not necessarily even the borrower it could be a loan officer who's under a lot of pressure to close so many loans a month to make the boss happy it's it could be any number of things and really before a lender is going to hire a quarter million dollars across the country they want to make sure that everything's legit absolutely you gotta have the checks and balances in...

Award-winning PDF software

Difference between 4506 and 4506t Form: What You Should Know

For Form 3520, a foreign person is any individual, corporation, foreign partnership or trust that does not have a principal place of business in the U.S. A foreign person is also any entity that: (1) is controlled, directly or indirectly, by a foreign person; (2) has an interest, directly or indirectly, in a partnership, limited liability company, trust, or estate created or organized in a foreign country; (3) engages in or has engaged in a trade, business or profession in a foreign country (but does not include a domestic entity that engages in a trade, business or profession in the U.S.); or (4) has established, directly or indirectly, a place of business in a foreign country. However, a foreign person does not include an entity organized under the laws of a foreign state or country or any U.S. resident corporation that is organized under the laws of a foreign state or country. Form 3520 should be completed on line 34. Instructions for Form 3520. Form 3520 Instructions: There are two sets of instructions for Form 3520: “Internal Revenue Service” and “The Franchise Tax Board.” These are the official versions (if applicable). Form 3520 Instructions from both sets of instructions: Form 3520 Instructions Internal Revenue Service Form 3520 Instructions The IRS Form 3520 is used to report a foreign gift, inheritance, or trust distribution from a foreign person. For Form 3520, a foreign person is any individual, corporation, foreign partnership or trust that does not have a principal place of business in the U.S. A foreign person is also any entity that:(1) is controlled, directly or indirectly, by a foreign person; (2) has an interest, directly or indirectly, in a partnership, limited liability company, trust, or estate created or organized in a foreign country; (3) engages in or has engaged in a trade, business or profession in a foreign country (but does not include a domestic entity that engages in a trade, business or profession in the U.S.); or (4) has established, directly or indirectly, a place of business in a foreign country. However, a foreign person does not include an entity organized under the laws of a foreign state or country or any U.S. resident corporation that is organized under the laws of a foreign state or country. Form 3520 should be completed on line 34.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Difference between 4506 and 4506t