Hi, I'm Lucy Reid. I'm a family barrister and mediator. I've made this video specifically for people who are going through a family court case without a lawyer to explain things to them. The video is primarily intended for parents involved in disputes about their children, but it should also be helpful if you're involved in another type of family court case, such as a financial dispute after separation. As a family barrister, I attend court on a regular basis, dealing with these types of cases. I understand that coming to court, especially for the first time without legal representation, can be a very stressful and confusing experience. I remember the nerves I had when I first started as a lawyer and had to speak in court. I have firsthand experience of the stress involved in representing myself. Every day, I meet litigants in person who are finding the whole process very stressful. I would like to help make it a bit easier. Please note that this video is not legal advice, but I hope it will be helpful to you. Although you may still feel nervous about what will happen with your case, my aim is to talk through some of the practical aspects, so you have less to worry about and can focus on saying what you want to say to the judge. This video is the second of three videos that I've made. It might make more sense if you've already watched the first video. In the last video, I talked about preparing yourself for court and what might happen prior to the hearing. However, we didn't explore what the courtroom itself looks like. In this video, I'll focus on what might occur during the first court hearing and show you what the courtroom might look like. Please make sure to...

Award-winning PDF software

13873-t Form: What You Should Know

The document contains information from a tax return. 2. At the time the document was served to the taxpayer, the document did not have the word “non-filers” entered the "Filing Status” box or “Non-Filing Status” in the “Filing Date” box. 3. The document is served by leaving the document with the taxpayer at the time the document was served. 4. The document was not received by the taxpayer by mail and was not mailed to the taxpayer's last known mailbox address to ensure that no return was sent to the taxpayer's last known mailbox address 5. The document is not marked as a verified return. 6. The information in the document is not correct. 7. The document was marked as a verified return. 9. If you received a document or a transcript that: 1) is a photocopy of a previously filed return and 2) contains information from a previously filed return, you do not have to do anything differently to receive it, provided that: 3. The document or transcripts does not contain the word “non-filers” entered the "Filing Status” box or “Non-Filing Status” in the “Filing Date” box; 4. The document or transcripts was served on the taxpayer at the place where the taxpayer receives mail; 5. The document or transcript did not contain the word “non-filers” entered the "Filing Status” box or “Non-Filing Status” in the “Filing Date” box; 6. The document or transcripts was not mailed to the taxpayer at the place where the taxpayer receives mail; 7. The document or transcripts was not printed, typed, or otherwise issued to the taxpayer by the Treasury Inspector General for Tax Administration (TI GTA); 8. The document or transcripts do not contain information, including an error identification number, for any other IRS document; 9. If you previously received a document or a transcription that: 1. was not originally received by the taxpayer 2. was not mailed to the taxpayer to the place at which the taxpayer receives mail, the document or transcript 3. was not marked as a verified return and 4. did not contain the word “non-filers” entered the "Filing Status” box or “Non-Filing Status” in the “Filing Date” box. 6.

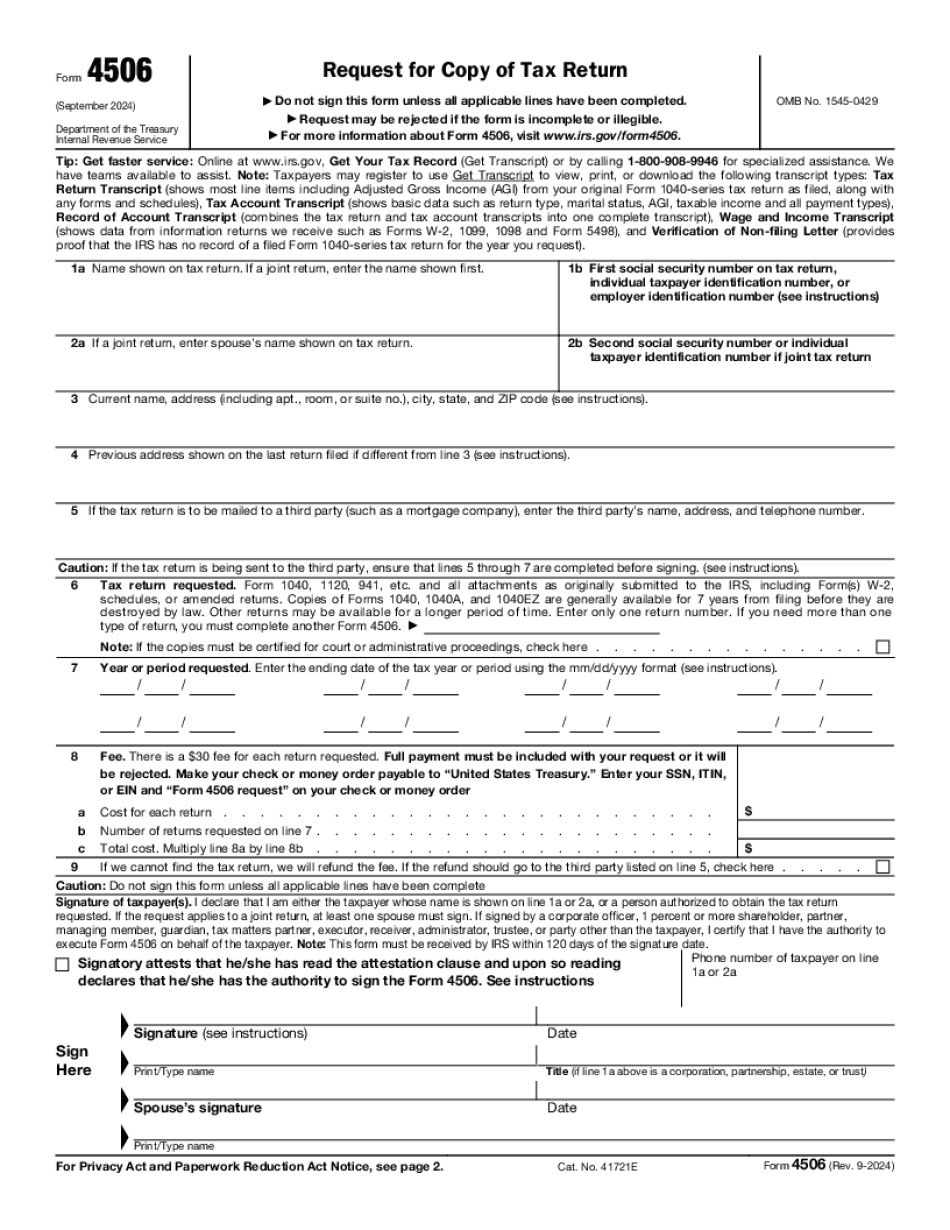

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 13873-t