Award-winning PDF software

Form 4506 online Knoxville Tennessee: What You Should Know

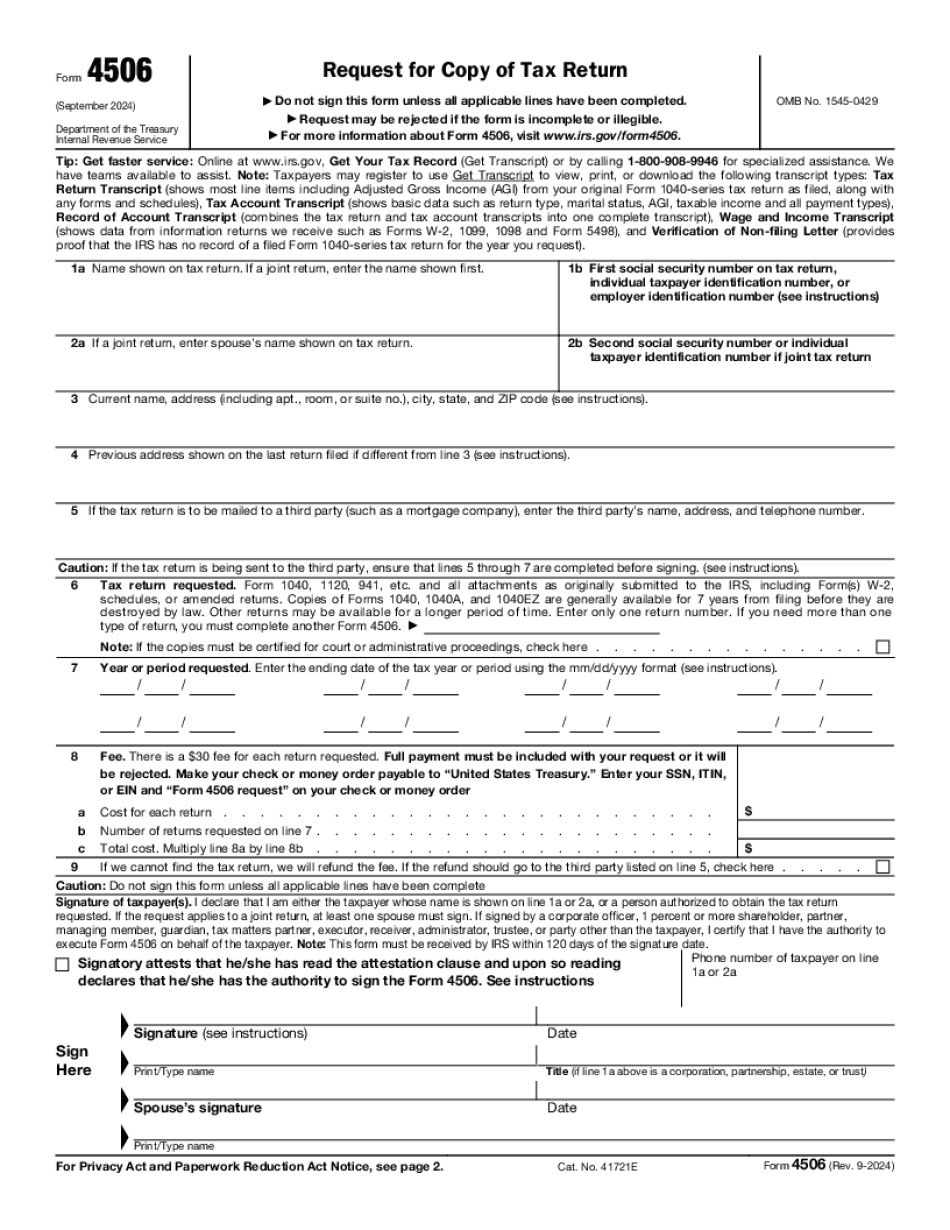

Form 4506-T — USCIS This form permits the USCIS to provide the IRS with tax return information when verifying information needed for a COVID-19 IDL Disaster loan assistance. Form 4506-T-EZ — USCIS This form permits the USCIS to provide the IRS with the tax return information needed to perform proof of income verification. Form 4501, Request for Copy of Foreign Income Tax Return Your Form 4506 is for your foreign income taxes or foreign tax credits. You can sign and date your tax return before completing your return to authorize the IRS to provide your return to the Department of the Treasury. You need the following information to sign and date a copy of your tax return: — A clear and legible signature. The signature should be typed exactly and legible using two or three sets of capital letters and a full spread type printer. Two lines should be drawn from the right to the left. The signature line should be approximately one inch from the edge. An ink pen and a permanent marker should be used to give your signature a handwritten style. — A return receipt or a copy of your Form 1040 (or 1041) in the same envelope. — A valid credit card or debit card should be used to make the payment. — An address should be included to make the return filing. — Your personal identification number (PIN). To check your PIN, follow the procedure below: — Log into IRS.gov with your personal ID (Social Security number or driver's license). — Select Forms and Instructions > Payments. You will find your PIN under Payment Type. — Click on the pay Now button. You will be directed to the Forms and Instructions > Payment Type menu item. — Select Your Payee. Then enter the IRS customer number (01-00-13-14-00-20-22-28 and enter 1 if using an automated payroll deduction). — Enter any other verification information (e.g., address, employment status) as you would for submitting an electronically filed return. — Make sure to sign and date the return. — Attach a copy of your completed Form 4506 to this letter.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506 online Knoxville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506 online Knoxville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506 online Knoxville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506 online Knoxville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.