Award-winning PDF software

Form 4506 Sandy Springs Georgia: What You Should Know

Georgia's Veterinary Rehabilitation Program includes: Rescue and Rehab Recover from a major trauma Advanced surgical care Comprehensive rehabilitation of broken limbs Specialty veterinary care for pets with medical conditions including chronic renal failure, chronic diabetes, skin and eye diseases. The hospital is dedicated to providing the services you demand to the pets and clients. Georgia Veterinary Rehabilitation will treat your pets for any medical condition that may cause pain and suffering. It provides treatment including medical, surgical and rehabilitation treatments, all in a caring environment. Our goal is to make sure your pet's happy and healthy long-term. And to make sure your pets are loved for the rest of their lives. As the only facility of its kind in Georgia dedicated to the care of large and elite dogs, The Vet Center of Marietta has treated over 3,000 patients. We will help your pets stay healthy and happy. We hope you can find the help and support you need. Please call 404.543.0233 for more information. Marietta, GA — Blue Pearl Category: Forms and Applications. Type: PDF. Department: Revenue. 9/01/11. Blue Pearl Tax Refund Request. Reference: F001. Tax Return Preparer's Guide for Individuals — IRS This guide explains the tax return preparation process for individuals so that they may accurately and promptly file their federal tax return each tax season. It addresses the filing requirements for individual taxpayers, including the filing status, tax year and the payment options. To prepare a tax return, you have the following responsibilities. Filing and Processing the U.S. Tax Return A. You can file Form W-7. You are responsible for preparing and filing such form. If such tax form is not available, you can file the following: Form 6030X, U.S. Individual Income Tax Return. Form 5020. You can file Form 5020. For more information, see page 24 of Publication 514. Filing the Form 1040. You must file the U.S. federal income tax return for the tax year shown on the Form 1040 for which you are filing. If such tax return is not available, you can file the following for the year shown on the Form 1040: Form 1040. Form 1040A. You can file Form 1040A. For more information, see page 12 of Publication 514. You can file Form 8606, U.S.

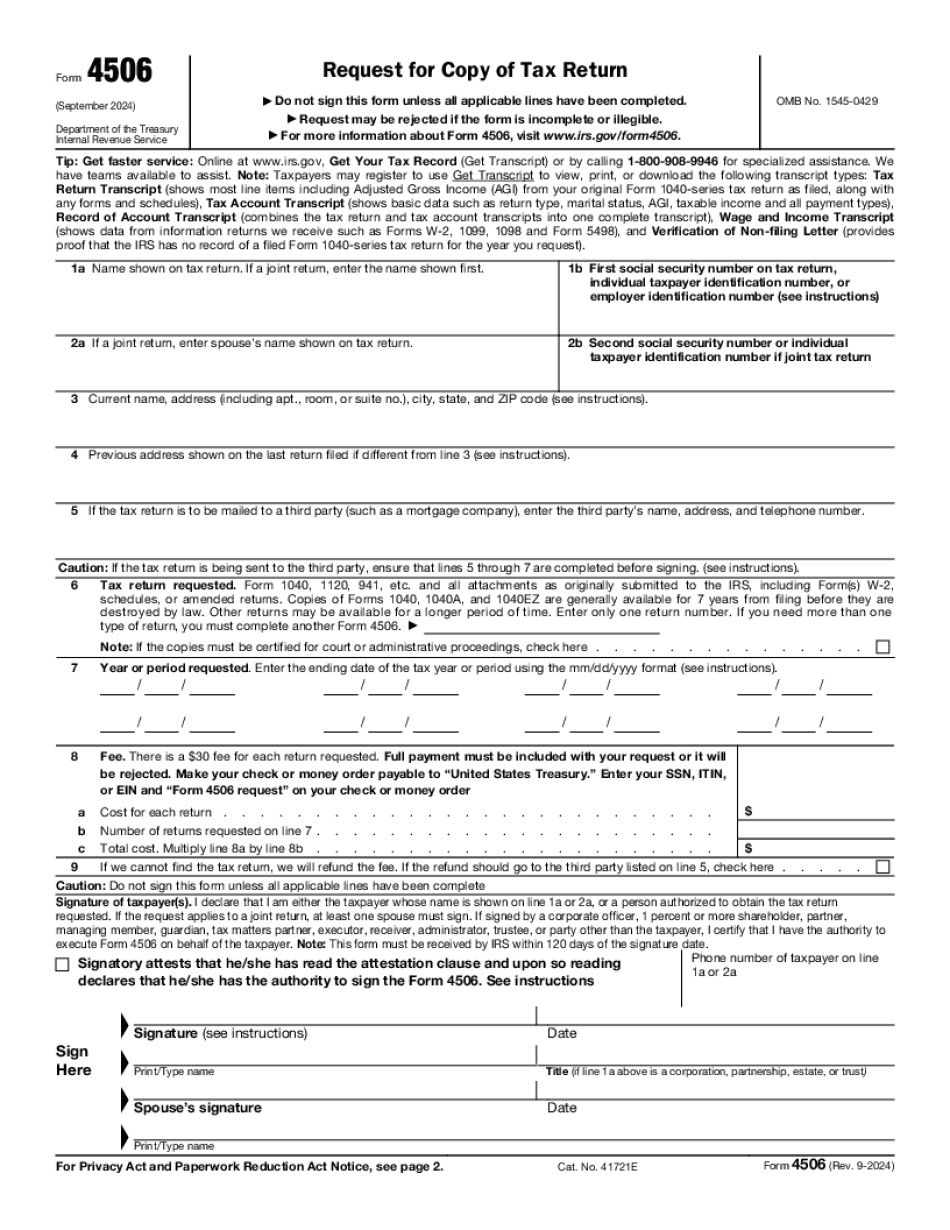

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506 Sandy Springs Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506 Sandy Springs Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506 Sandy Springs Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506 Sandy Springs Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.