Award-winning PDF software

McAllen Texas Form 4506: What You Should Know

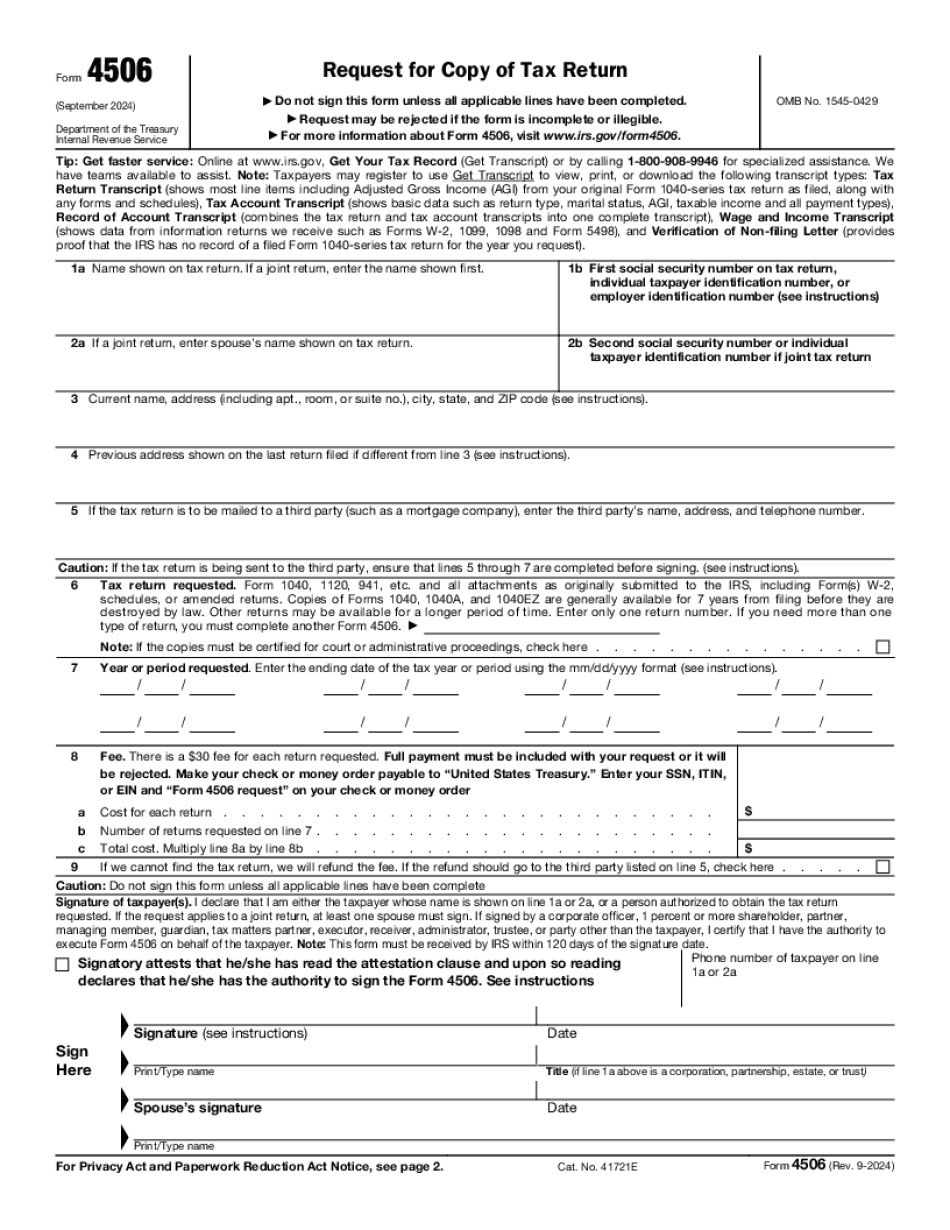

Form 4506-T, IRS Transcript Services Program. Taxpayer Identification Number, (TIN), may be required. Find the IRS TIN on the back of the form To be eligible for transcripts and access to the service, a large, or medium-sized employer must (a) have a minimum of 50 full-time employees or (b) have total assets in excess of 150,000,000 The transcript request must be completed and signed by the principal and any owners controlling 20 per cent or more of a business. The following documents should be attached: Form 4506-T: Request for Transcript of Tax Return — Investopedia Form 4506 is also used by large corporations. If you are a C corporation, you must file this form with all of its returns. Form 4506 is also used by C corporations for tax purposes. This tax form can help your tax liability. It also shows if you are a qualifying small business. If you are a corporation, this form can help maintain and increase profits. You can check with your tax professional to be sure you qualify. This form is intended for companies that file annual Schedule C form EZ (Individual Income Tax Return). If you file quarterly (or less frequent), then you must file Form 1040, or Form 1040NR. This tax form can assist you get your taxes into record in the fastest possible time. The information you need to know as to what should be included, including a complete name, address and business type (e.g. S corporation, Ltd.), should appear on the statement. If your business is a sole proprietorship, only the business name and your taxpayer identification number must appear on the return. Income of an LLC will be displayed in box 8. Boxes that have been checked out at the beginning of the return will now be considered completed. Form 4506, Request for Transcript of Tax Return — IRS Note: The form will be available on this page for about 3 days. This tax form can be used as a reference to help you answer a number of questions or verify information you provided on another type of tax return to determine the amount and type of tax due as well as how to report it.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete McAllen Texas Form 4506, keep away from glitches and furnish it inside a timely method:

How to complete a McAllen Texas Form 4506?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your McAllen Texas Form 4506 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your McAllen Texas Form 4506 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.