Award-winning PDF software

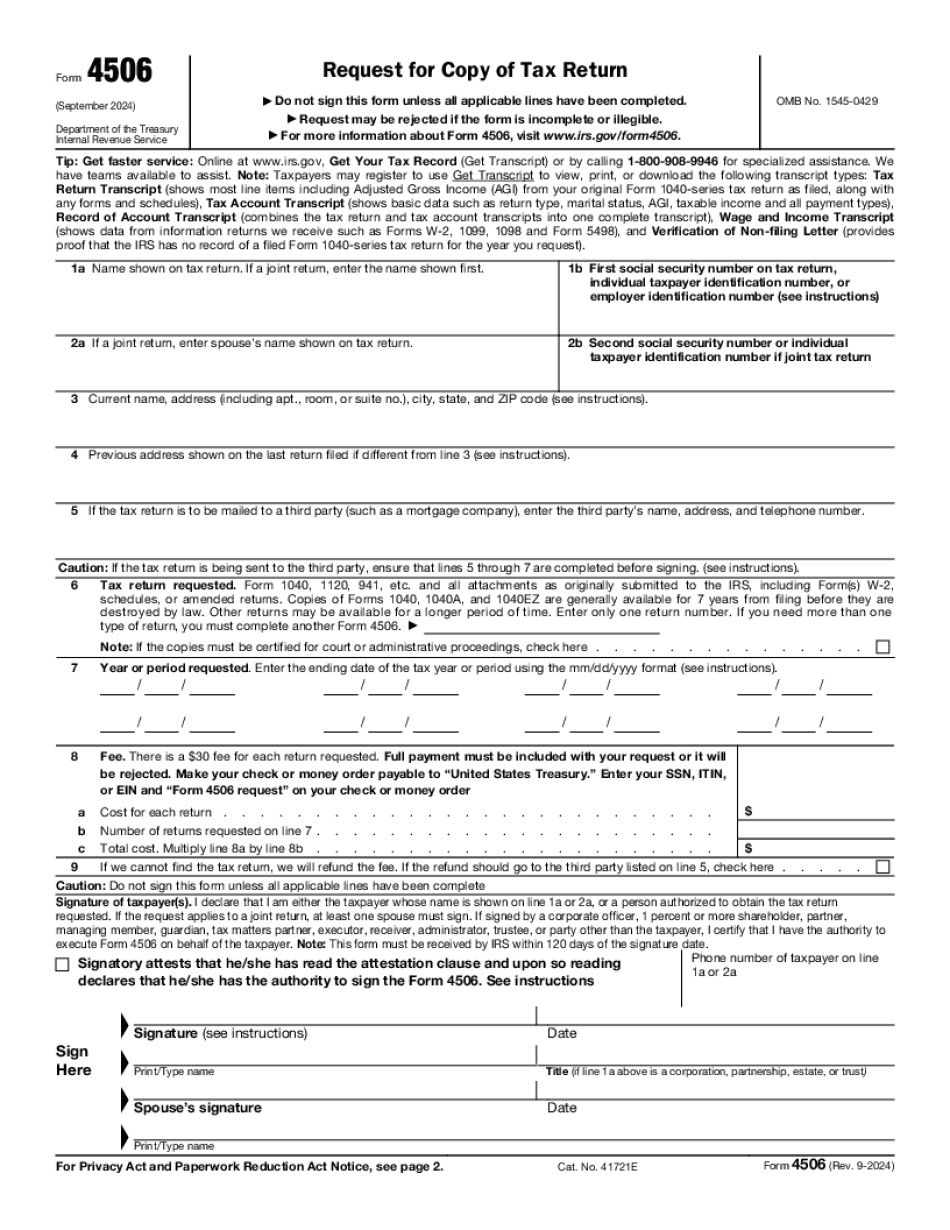

Miami Gardens Florida Form 4506: What You Should Know

The taxpayer claimed that because no notice of assessment (NOA) had been mailed to him by the Department of Revenue, he lacked standing to challenge the Department's former practice. The NOA was issued to his business without a hearing, in violation of section 7-203(9) of the Florida Statutes, which clearly gives a taxpayer standing to challenge the lack of an NOA hearing. Therefore, the Department of Revenue's decision to issue an NOA without a hearing is also unconstitutional. The taxpayer challenged the decision of the Department of Revenue under section 7-203(9)(n) of the Florida Statutes on behalf of himself and his two employees, Jose Applebaum and Jose Applebaum, Jr. on March 28, 2014, and obtained a hearing on the matter on March 28, 2014, under section 7-203(10) of the Florida Statutes. The Taxpayer has not had a hearing and has not submitted any paperwork, so the Taxpayer has waived all rights to a hearing and the decision is final and without appeal. Under section 7-203(9) of the Florida Statutes, no person shall be liable under subsections (1) to (7) to (10) of this section unless such decision is based upon a claim in writing that such person is either a minor or incapacitated or is incompetent. This provision should not apply to a taxpayer because the taxpayer was not presented with a decision of the Tax Division of the Department of Revenue prior to issuance of the NOA to the business of Haller Robbins. Under section 7-203(9) of the Florida Statutes, no person shall be liable under subsections (1) to (7) to (10) of this section of such determination except the Commissioner of Revenue or an attorney of the Department of Revenue. However, the Commissioner of Revenue could have issued the NOA for the business of Haller Robbins without giving the taxpayer a chance to challenge the decision in the manner provided in section 7-203(10). Under the statute, the Commissioner of Revenue may set a hearing date with a showing of grounds for the denial of the taxpayer's appeal within 45 days of the date the taxpayer filed the Petition for a hearing with the Commissioner of Revenue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Miami Gardens Florida Form 4506, keep away from glitches and furnish it inside a timely method:

How to complete a Miami Gardens Florida Form 4506?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Miami Gardens Florida Form 4506 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Miami Gardens Florida Form 4506 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.