Award-winning PDF software

Form 4506 for Orange California: What You Should Know

So what happens if the IRS shuts down or closes the Tax Service? Jan 11 2025 — IRS Forms 4506, 4559 and 4608 are required by all the banks, lending companies, mortgage brokers, mortgage companies, mortgage lenders, finance companies, real estate agents, brokers, sellers, renters and others that have taken out loans since 2001. It might seem that this “new IRS rule” would not affect home buying decisions for potential homebuyers. The answer, however, is it depends on how you plan to pay your taxes if the IRS cuts off your bank account and your access to your taxpayer account or filing system. The Federal Tax Service has two parts. The first part is the Taxpayer Advocate Service and the second part is the Tax Court. As of January 1, 2010, the IRS cut off access to the Tax Courts and TAS. The Tax Court closed on the 15th, 2010. If they shut down the Tax Court as they have planned, the only option for homebuyers is to use the Taxpayer Advocate Service in Orange County. But that means there is less than two days until the IRS shuts off your bank account and tax filing system, and you might not be able to pay your taxes without them! When is the deadline? FEDERAL TAX SERVICE (FAST) ACT OF 2009 This is a short-term act (60 days). It requires the service to use the FAST (Foreign Account Reporting Analysis and Technology Act of 2002) software system to provide for faster, more accurate, and secure information reporting, due to the growing number of foreign citizens that use Swiss banks and other financial services and who frequently deposit their money in America. FAST was enacted to address the growing problem of money laundering. Money laundering is a crime. It is also one that affects both the U.S. and Switzerland and any country that facilitates the money laundering of criminal proceeds. If the FAST software is not being used in the timely manner, the money may remain in the foreign nation. The Federal tax administration will continue to enforce FAST through all the methods that it remains capable of using. What does FAST mean for tax professionals, taxpayers, and homebuyers? The goal of FAST is to help the U.S. government and other countries identify, investigate, and prosecute illicit foreign bank accounts and other financial transactions that may be illegal. Here is an excerpt from a blog post at the IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506 for Orange California, keep away from glitches and furnish it inside a timely method:

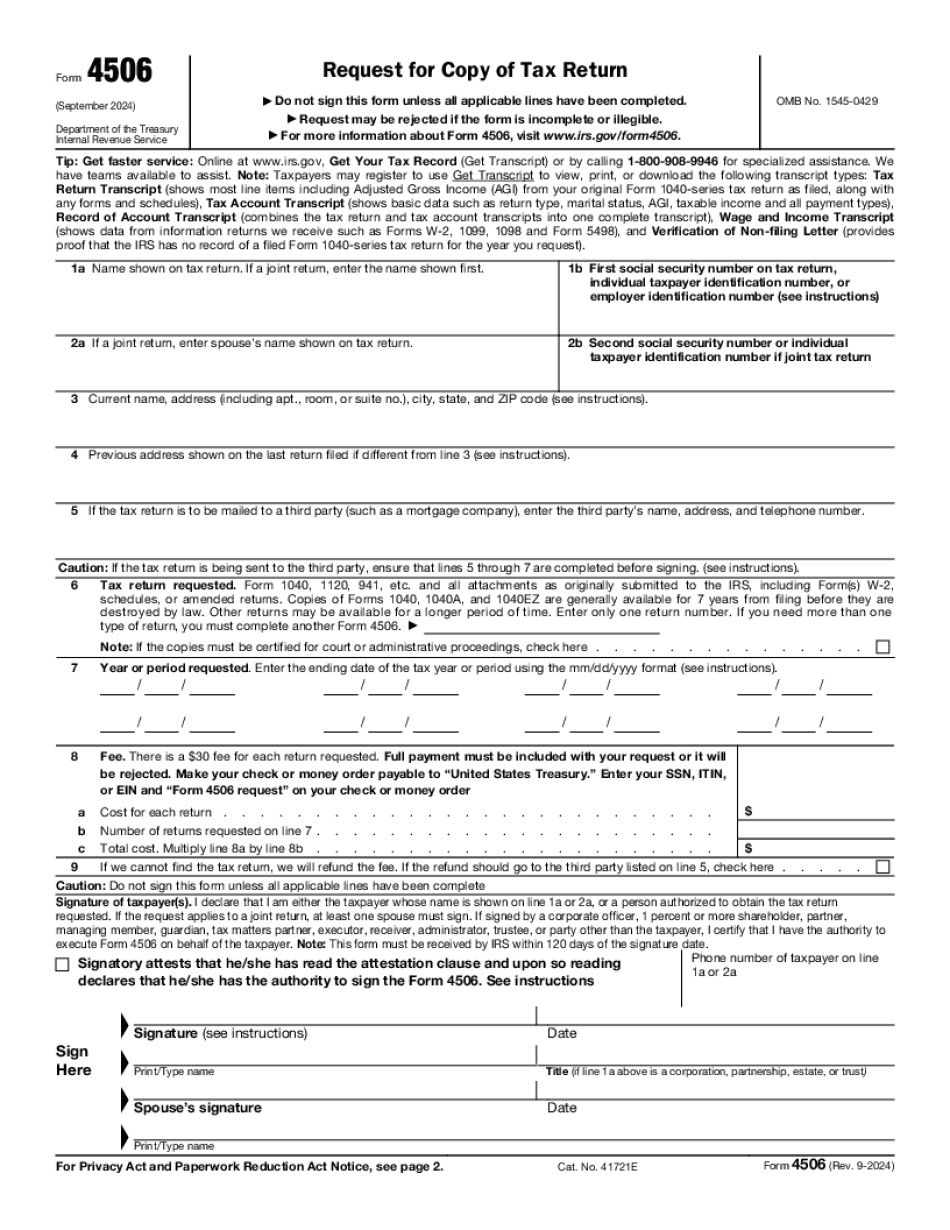

How to complete a Form 4506 for Orange California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506 for Orange California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506 for Orange California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.