Award-winning PDF software

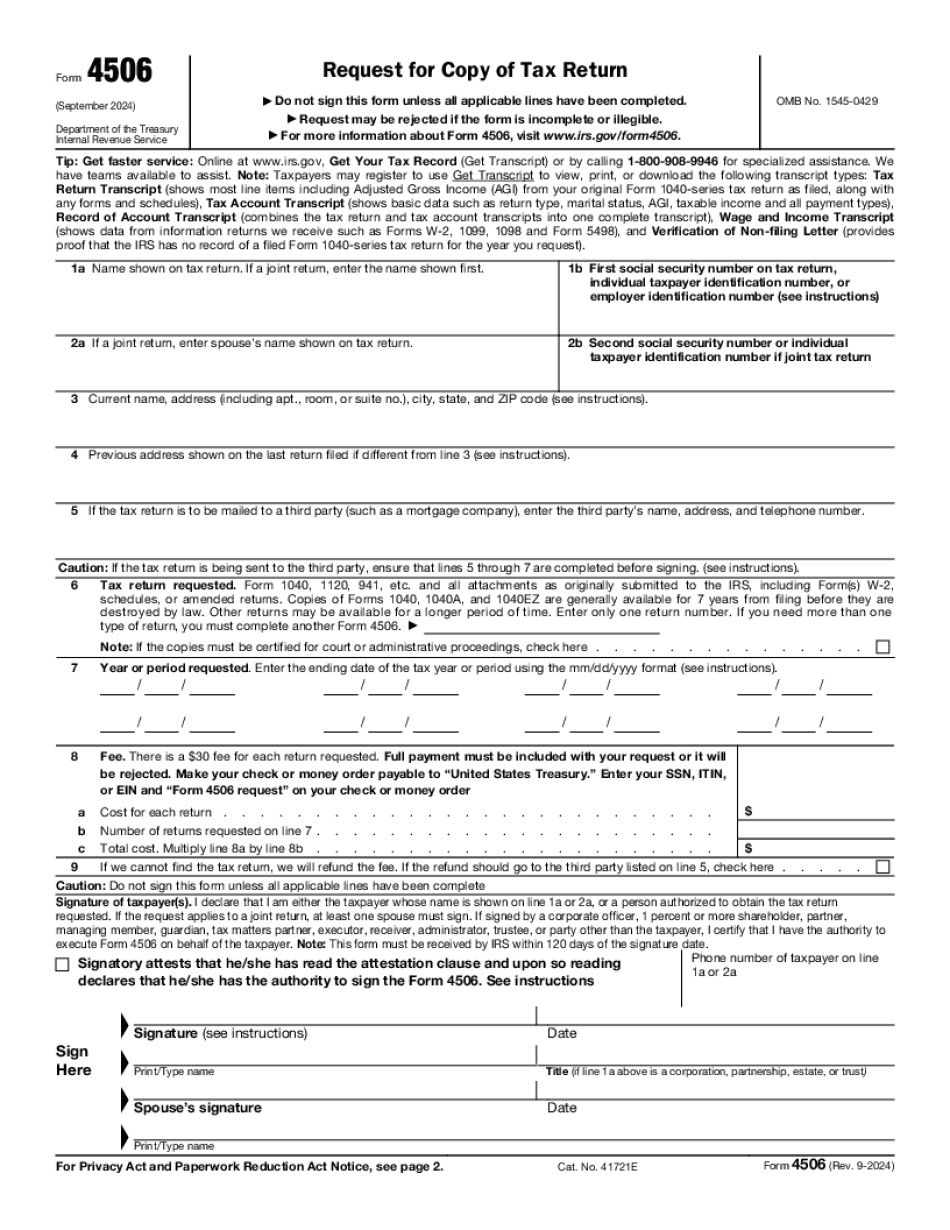

Printable Form 4506 San Diego California: What You Should Know

For example, if a taxpayer's tax return for 2025 had tax years 2025 through 2025 included, they would simply enter “2” in the box shown above. The Transcript Request Process. To submit your transcript request online, you can visit and click on the “Get Transcripts” link located in the left upper corner of the web page just above the heading on How to Submit a Transcript. Alternatively, you can contact the Taxpayer Advocate Service, the person who is responsible for collecting Taxpayer Advocate Fees if you would like to ask your questions about completing your transcript. You can also follow the steps in the “Getting Your Transcript” section to get a transcript from the National Transcript Clearing House, a non-profit organization that sends the transcripts directly to the Taxpayer Advocate Service (TAS). All IRS form 4506-t transcript requests must be received by 8:30 AM, CST, one business day after it has been received. Once your request has been received by the IRS, the TAS will review it. If the TAS determines your request is complete, they will notify you by telephone. It can then take up to 30 days for your transcript request to be processed in accordance with the law! The Transcript Request Fee for Form 4506-T is 30.00 (tax year) plus shipping and handling if ordered by email. In addition, the following fees may apply: Transcript Request for Individual Taxpayer With or Without a Dependent on the Return For individuals who do not have a dependent on their annual tax return, the Transcript Request Fee is 50.00 plus shipping and handling if ordered by email. Note: The “With or Without a Dependent” fee covers a person who files a return under the individual taxpayer's own name. It does not apply when a taxpayer reports a dependent for withholding, FICA or Medicaid and the dependent is not a “spouse, domestic partner or individual related by blood, marriage or adoption” (as described in the Code of Federal Regulations Section 1.4121-3T and 1.4121-5T). Blvd., San Diego, CA 92131;. Phone: 877.877.6188;. Participant # 302617;. Mailbox ID: CoreLogic.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 4506 San Diego California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 4506 San Diego California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 4506 San Diego California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 4506 San Diego California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.