Award-winning PDF software

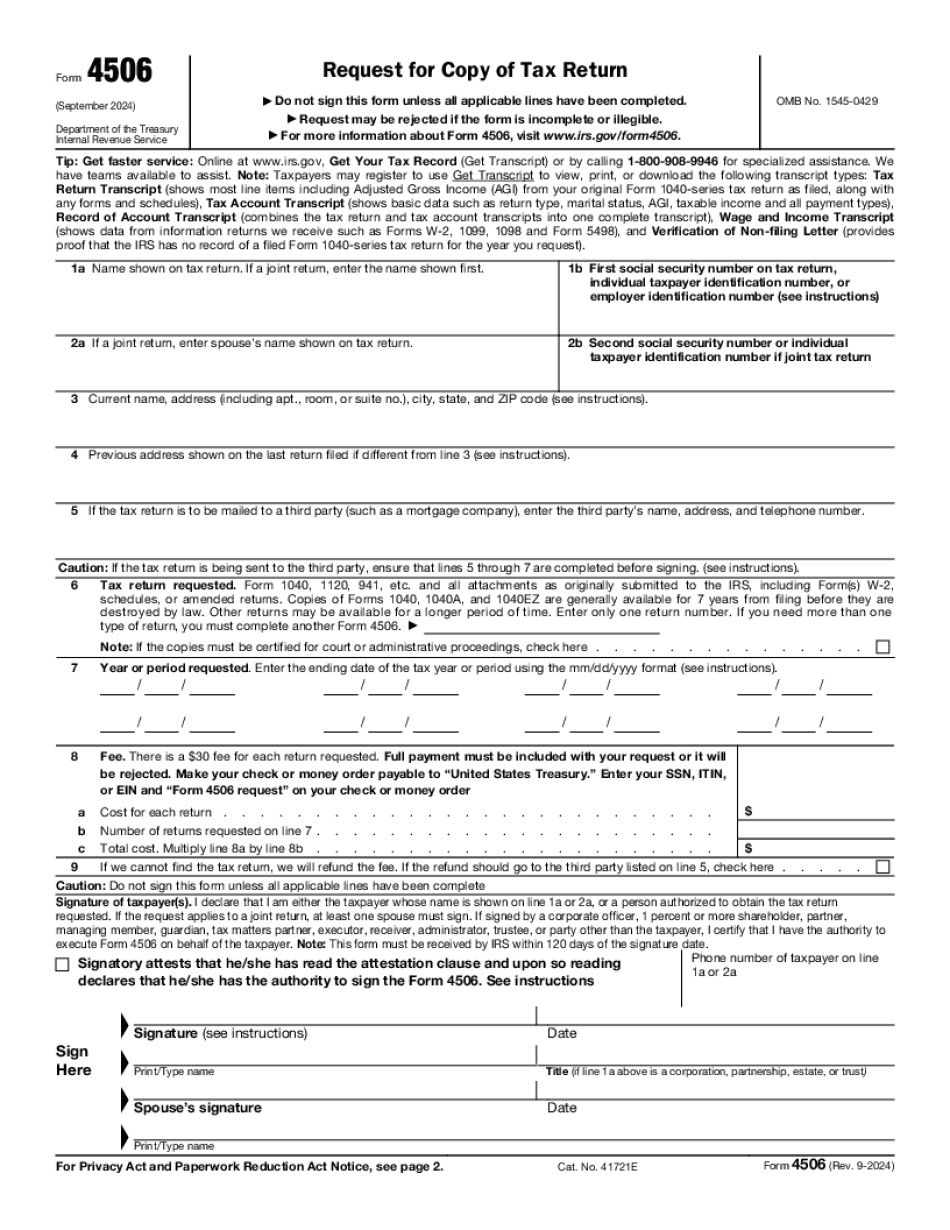

CO online Form 4506: What You Should Know

Are I Approved For a COVID-19 IDL Disaster Loan? You have the right to request a copy of your tax return and to identify and designate for other entities a third party that will review your tax return information prior to your loan being granted. The IRS has granted you an authority to get your tax return information by completing and signing Form 4506. The IRS Form 4506-T must be received at a local branch IRS facility no later than 3 weeks from the date of your request/request for copy of tax return. The Form 4506-T is provided for three (3) years from the date of your request/request for copy of tax return. You may not give your Social Security Number or Taxpayer ID Number to anyone other than an authorized IRS employee. The IRS does not accept any additional information or signatures when creating you tax return information. This request is a complete legal action within your control. It is your decision whether to give your Social Security Number or Taxpayer ID Number to anyone else. You can request a copy of your tax return by using Form 4506. You cannot designate a third party that you will receive your tax return information in advance. Form 4506 should not be filed by a third party. An authorized taxpayer representative is required to submit the Form 4506-T from the taxpayer who receives the tax return information. IRS Form 4506 and 4506-T (PDF file) are available for all individuals and small businesses; however, the procedures may differ depending on the financial situation of your business. The Form 4506-T is only appropriate for a business-related disaster loan request. The Small Business Administration (SBA) allows you to request your tax return information prior to making any disaster loan decisions. If you have completed Form 4506-T and submitted it electronically, SBA will process your request and send you two (2) copies of your requested tax return information. All SBA Disaster Loan applicants who do not have an IRS Form 4506 from the previous year are required to complete or have complete Form 4506-T. It must be completed or signed by an authorized SBA employee prior to the SBA loan approval. It is critical that your employee signs Form 6198 and Substantial Support Statement (for any disaster loan that is issued on or after May 31, 2014).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete CO online Form 4506, keep away from glitches and furnish it inside a timely method:

How to complete a CO online Form 4506?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your CO online Form 4506 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your CO online Form 4506 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.