Editable IRS Form 4506 for 2024-2025

Show details

Hide details

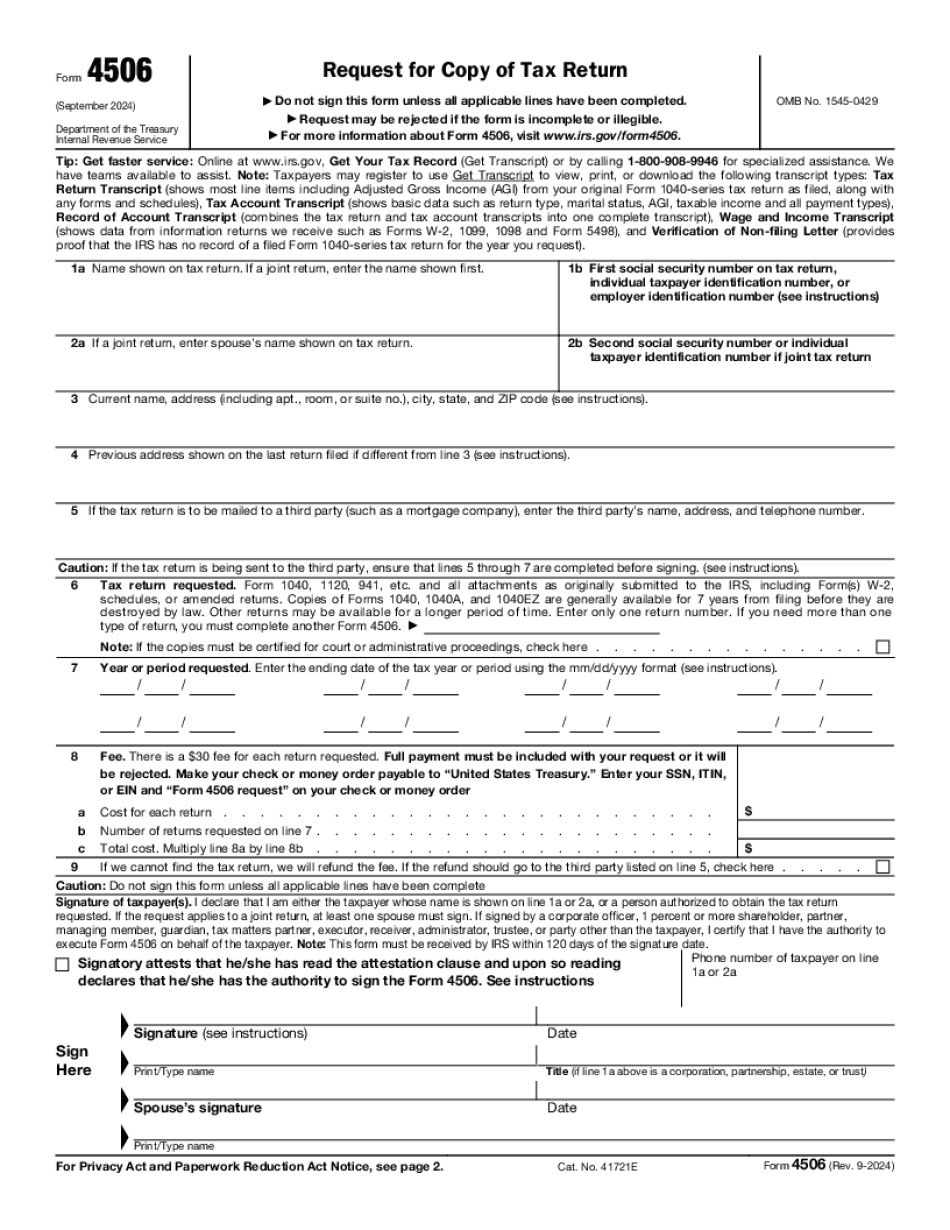

Request. If you request a copy of a tax return sections 6103 and 6109 require you to provide this information including your SSN or EIN to process your request. General Instructions lines have been completed. Purpose of form. Use Form 4506 to request a copy of your tax return. You can also designate on line 5 a third party to receive the tax return. How long will it take It may take up to 75 calendar days for us to process your request. Information about any recent developments affecting Form ...

4.5 satisfied · 46 votes

form-4506.com is not affiliated with IRS

Filling out Form 4506 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form 4506

Every person must declare their finances in a timely manner during tax season, providing information the Internal Revenue Service requires as precisely as possible. If you need to Form 4506, our reliable and intuitive service is here at your disposal.

Follow the instructions below to Form 4506 promptly and precisely:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official guidelines (if available) for your form fill-out and accurately provide all information required in their appropriate fields.

- 03Complete your document using the Text tool and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Take advantage of the Highlight option to stress particular details and Erase if something is not applicable anymore.

- 06Click the page arrangements key on the left to rotate or delete unnecessary document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and create your legally-binding eSignature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or select Mail by USPS to request postal document delivery.

Opt for the most efficient way to Form 4506 and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is get the irs Form 4506 T 2019-2025?

Online solutions enable you to organize your document administration and increase the productiveness of your workflow. Look through the short guideline as a way to fill out IRS get the IRS Form 4506 T 2019-2025, avoid errors and furnish it in a timely manner:

How to complete a how to get Copy Of Tax Return?

- 01On the website hosting the blank, click Start Now and move towards the editor.

- 02Use the clues to complete the applicable fields.

- 03Include your personal data and contact data.

- 04Make certain that you enter suitable data and numbers in appropriate fields.

- 05Carefully check the content of the form so as grammar and spelling.

- 06Refer to Help section if you have any issues or contact our Support team.

- 07Put an digital signature on the get the IRS Form 4506 T 2019 2020 printable while using the assistance of Sign Tool.

- 08Once document is completed, press Done.

- 09Distribute the ready document by way of electronic mail or fax, print it out or save on your gadget.

PDF editor enables you to make alterations in your get the IRS Form 4506 T 2019-2025 Fill Online from any internet linked device, personalize it based on your requirements, sign it electronically and distribute in several ways.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 4506?

You can use Form 4506 to change the circumstances of your income (including capital gains) and deductions (including standard deduction) for the year. It is used to change your basis in inventory, business property, and other property.

When you use Form 4506, it is a tax event in the tax year to which it pertains, and in all subsequent tax years. Any amounts that would have been subject to tax in the year it was filed are taken directly out of the first year of your income.

Can I use Form 4506 to increase or decrease my basis in business property?

Yes, you may claim an increase in your basis in property of more than 10,000.

Can I use Form 4506 to increase or decrease the basis of furniture, tools, fixtures, and equipment?

No. The basis for each item varies depending on whether the item is a personal property or business property.

Does Form 4506 create a loss for the year?

No. The loss in a year is a non-capital loss, which must be reported on Form 1040, Schedule A.

What is the maximum amount that a taxpayer can claim on an reimbursed basis for an expense that does not result in a capital loss?

This amount is called the allowable expense deduction. For instance, let's assume your business-related expenses are 100,000 for 2013. Any expenses you incurred that do not result in a capital loss, or that result in a gain, are eligible for the allowable expense deduction. Your allowable expense deduction for this year is 20,000. You can claim an additional 20,000 on the same type of expense for any year during the next 5 tax years for a total amount of 60,000. Your employer also can claim an additional 20,000 deduction each year (up to 120,000 total) if the expenses are for services provided for a business purpose. The amount of your allowable loss on personal-use property must be reduced in the following way:

Your allowable loss for personal-use property cannot exceed the amount of your allowable expense deduction.

This limit begins to decline each year after the 10th year, when you may claim the whole net loss for any portion or parts of the business in which you own at least 50 percent.

Who should complete Form 4506?

The CRA does not recommend completing Form 4506 for individuals. The Form 4506 requires information about a taxpayer's financial circumstances before providing a full assessment. This information might be used in connection with a review of the taxpayer's individual tax return and, as described further later in this guide, in deciding appropriate tax assessments.

Form 4506 is not intended as a substitute for the taxpayer's own tax return. The CRA cannot tell you how to prepare and file your own taxes. The CRA also cannot assess the amount of any penalty or interest you may have to pay under the Income Tax Act. For more information, see our publication: Assessment Tool — Filing your return.

If you need an assessment, use the appropriate document for your situation (like a notice of assessment or the Canada Revenue Agency's Guide for Individuals — Filing Individual Tax Returns). If the tax return you are filing is missing the information for Form 4506, you should file Form 4506 even if you are not requesting one.

What is included in Form 4506?

The information on this form is provided without charge to you. However, no tax is deducted or withheld by CRA for providing this information.

For more information about the information on this form, see Information You Need to File Form 4506 or get a copy.

Note: The information on this form is meant to give you general information about a taxpayer's personal tax situation. You should not count on it being accurate. For more information about the tax implications of specific events, see Notice 244–2–1, Assessment and Penalties.

Is the information on each of the seven sections on this form for your situation unique?

No. The information in each of the seven chapters on the form is general information that may help you and the CRA in making tax assessments. For example, many chapters address income, capital gains and credits. Each section may be completed if all the information in the chapter relates to your personal and business tax situation.

Are you told why a particular tax assessment is being made?

Yes. Each chapter of the form includes a paragraph that explains the reason for the assessment. For example, the paragraph states:

“A tax assessment is being made to assess: ...”;

“I am being asked to assess: ...”;

“To assess: ...”.

The paragraphs provide the exact basis for the assessment and the penalty or interest being assessed by the CRA.

When do I need to complete Form 4506?

S. Person or a resident of the United States and is a taxpayer for a United States source income year if the taxpayer or the spouse meets any applicable qualification requirements of subparagraph (D) of this paragraph (determined without regard to subparagraph (I) thereof); or (D) the taxpayer is a United States person and is described in section 988(a)(1)(B) and the taxpayer has an applicable determination year, and subparagraph (B)(i) of section 988(f)(2) of this title (relating to income excluded because of section 938(a)(1)(B)) applies. (C)(i) Did not have any qualifying individual (within the meaning of section 911(a)(5)) for the taxable year; (ii) had such amount of gross income; and (iii) had other income (other than net capital gain, as defined in section 951) of more than 1,000 (in 1-thousand dollars).

Can I create my own Form 4506?

You may create a custom Form 4506 and have the FAA use it to complete any form within the FAA's Office of Operations Support.

For additional information regarding FAA form 4506, please see.

How do I get a copy of my Form 4506 (Form 4510)?

You may request a copy of your Form 4506.

What should I do with Form 4506 when it’s complete?

When your Form 4506 has been completed, be sure to return the completed form to the nearest U.S. Embassy or Consul Office. If you are not located in the United States, you are advised to mail the completed Form 4506 to the following address:

Ambassador of the United States

Department of State

Attn: U.S. Embassies, Consulates and Territories

P.O. Box 1218

Syracuse, New York 13

What can I do when Form 4506 does not indicate that I have the required funds or assets to pay taxes?

A delinquent tax return can delay, interfere or even halt the processing of your Form 4506. If you cannot answer the question or do not believe that you have the funds or assets to pay the tax due, complete the “Certification of Tax Compliance” to request a review of the payment options.

When will I receive a notice about a payment option?

We work with you to determine what payment options are appropriate for your case. If the tax return is still pending, you may be contacted about a new payment option in a timely manner. If a payment has been provided, we review the payment and determine whether it meets our criteria for the payment. For instance, most of the time, U.S. citizens have income subject to the withholding tax, but they may choose to avoid the withholding tax by paying all taxes in full, but have not met the required assets for the payment. If the payment is determined to be appropriate, you may be contacted about a new payment method in a timely manner.

Doesn't the IRS require that Form 4506 be filed for all foreign earned income of all U.S. citizens?

Yes. The IRS uses foreign earned income (“FIE”) and foreign housing expenses (“FHA”) to measure the foreign source income of U.S. persons with respect to their U.S. return and may require you to file a new Form 4506 (“Form 4506-F (Foreign Earned Income)) if your U.S. FIE or FMA exceeded the applicable threshold. If you are filing a joint return, you may be required to sign Form 706 and attach it to your Form 4506. For additional information on the tax consequences of FIE and FMA, see our publication, “The Foreign Earned Income Tax Act: Frequently Asked Questions.

How do I get my Form 4506?

You will send a signed copy of your tax return, or original or certified copy of an original IRS Form W-4, W-2C, or I-9/I-10 for filing returns to the address on your Form 4506. We may be able to obtain a copy of your social security card, tax return, or government document if required. (Note: If you receive Form 4506 for filing your taxes, you should keep it to help you document the filing of your tax return.)

How do I submit my Form 4506?

Attach a copy of this information to your tax return. (You should keep a copy for your records.) Make sure the Form 4506 is completed and signed. Mail or deliver the form to the address below.

Mail to:

Tribal Tax Center

PO Box 1243

Kirkwood, MO 63666

(We cannot accept payment by cash or check.)

If you have any questions, please call.

What documents do I need to attach to my Form 4506?

Attach a letter on official stationery addressed to your tax preparer.

If your tax return or tax return transcript, or a copy of a signed (but not dated) original tax return is received before the official filing due date, you do not have to file Form 4506. See the sections below for more details.

If your tax return or tax return transcript, or a copy of a signed (but not dated) original tax return is received later than the official filing due date, you must file a Form 4506. You must make and attach a statement with your return if you meet both of the following requirements:

To make Form 4506, you must file Form 4503 (or 4505 if you're filing a joint return).

The letter should be on official stationery and include all the following:

Name of tax preparer(s).

Identification of you and your spouse.

Date the return(BS) was prepared.

Description of the return(BS).

Copy or other confirmation of the address to which the return(BS) is to be sent.

Your signature.

The letter should be made on official stationery.

If you are required to file an amended return, attach a copy of the amended return with your Form 4506.

Form 4506-V

Required when you changed your address on Form 4503.

Required if you were required to file an amended return for this return even though you changed your address by the date stated on Form 4503.

If you're filing an amended return that contains a change in your address, but the correct address of the taxpayer who filed Form 4503 appears on the return (as shown in box 7 or 8 of the Form 4503), you must attach a Form 4506-V. That version of Form 4506-V contains information on why you can't send another copy of Form 4503.

If you're filing an amended return that only has changed the address of the taxpayer who filed a copy of Form 4503 on the return, you must attach a nonresident return to that return. That Form 4506-V contains information on why you can't send another copy of your Form 4503.

You also must attach a nonresident return to any return the taxpayer sends you if its original return was received by you after the original return was due.

What are the different types of Form 4506?

How many are there? Are they available to all?

There are three different types of Form 4506:

Type 1: Nonimmigrant Business

Nonimmigrant Business Type 1 is the original type of immigration status (form 2115). These were the first types of immigrant status that Congress created. Nonimmigrant Business Types 1 and 2 are permanent (as opposed to temporary) as they do not expire after 1 year. Non-immigrant Business Types 1 and 2 need an Alien Registration Number (ARN) and an Employment Authorization Document (EAD) if employed under the nonimmigrant visa program. A nonimmigrant is defined as “one who enters, resides, or is physically present in the United States on a temporary or permanent basis, other than in pursuance of a diplomatic or similar diplomatic mission or in the performance of a professional or other specific assignment or mission outside the United States.” It is not necessary to file the additional Form 2257 to continue to have nonimmigrant status. Form 2115 is the original form that is used for nonimmigrants. Other than a temporary business in accordance with a nonimmigrant visa program, nonimmigrant business is also used under a foreign service officer (SO) sponsorship or consular post's sponsorship. Form 2115 only works for employees of U.S. based firms. It is not suitable for an employee of a foreign firm unless the employee enters the United States under an employer-sponsored H1B visa.

Nonimmigrant Business Type 1 is the original type of immigration status (form 2115). These were the first types of immigrant status that Congress created. Nonimmigrant Business Types 1 and 2 are permanent (as opposed to temporary) as they do not expire after 1 year. Non-immigrant Business Types 1 and 2 need an Alien Registration Number (ARN) and an Employment Authorization Document (EAD) if employed under the nonimmigrant visa program. A nonimmigrant is defined as “one who enters, resides, or is physically present in the United States on a temporary or permanent basis, other than in pursuance of a diplomatic or similar diplomatic mission or in the performance of a professional or other specific assignment or mission outside the United States.” It is not necessary to file the additional Form 2257 to continue to have nonimmigrant status. Form 2115 is the original form that is used for nonimmigrants.

How many people fill out Form 4506 each year?

On average, 40,000 people filled out Form 4506, approximately 15 percent of all people eligible to receive a Social Security benefit. For more information about filing for benefits, see the fact sheet on filing for Social Security, and look for “Filling Out the Form 4506” in the next section of this publication for information about the form and what is required to file it.

How many people receive Social Security benefits based on a disability?

The Social Security Administration (SSA) receives a lot of requests for disability benefits. If you have a form of severe and chronic disability (SDI or SSI), you may be eligible to receive benefits based on your status as a person with a disability.

What can I do to prove that I have a disability, and I'm receiving these benefits?

To find out more about receiving Social Security disability benefits, or for more information including how often you may receive benefits, you can contact the SSA Office of Disability Resource and Referral. This office can help you develop a plan with your health care providers to help improve your life and support you during your recovery.

Can I get benefits without being totally disabled?

Yes. The main requirement for receiving Social Security benefits is that you must be receiving SSI, SDI, or SSI and SDI. You must be totally disabled and receive at least 50 percent of your disability benefit payments as SDI.

What does it mean to be totally disabled?

“Totally disabled” means that you receive at least 50 percent of your total disability benefit payments as SDI. You may also be partially disabled and receive a portion of your disability benefit.

How long do I have to wait for a disability benefit?

Social Security is required to grant disability benefits for a minimum of 5 years. Once the disability application is approved, and before the benefit starts, you will wait for a hearing or until the application is denied.

You have a right to a hearing. If you disagree with the Social Security (and often the decision on your application) you may have an appeal. To get an appeal, you must make an application and pay all related fees for the appeal. The appeal can be to make the disability application (application for benefits); to request that you be reinstated; or to ask for an increase in your benefits, if the Social Security (and likely your health care providers) disagree with the decision(s) of your health care providers.

Is there a due date for Form 4506?

A. An employer must file Form 4506 beginning in the applicable April 15th month for the prior year, and ending in the applicable June 15th month for the succeeding year, after which date the taxpayer may not claim for federal income tax purposes any losses.

Q. Why are the dates different if they are in the same year?

A. The IRS does allow companies to use one of two different dates: the April 15th due date or the June 15th date. The IRS will let you know whether it approved the tax year you filed. A few years ago the IRS started to approve only April 15th dates, since it is the date that the employees get their first paycheck. Since most employees start their first paycheck at the beginning of April, this date was often the only one that was approved.

Q. If I filed a return using the April 15th due date and the government denied it (but the year was already filed), where should I file my next return?

A. You may file it using Form 6251, Request for Correction of Tax Withholding. If the form is not approved, the government will refund you the amount of money you had been withholding.

Q. What if my employer filed a form 4506 using April 15th as the deadline? How do I know if my return should have been filed using the due date based on that form?

A. The information in this paragraph applies the due date on the company form. If the return was filed using the April 15th due date, you must file a Form 8600 or Form 8690 using Form 4689 with the Department of Labor to complete your return. If the Return was filed using the June 15th due date, you will file a Form 4690 using Form 1248, Corrected Employer's Tax Return, with the Department of Labor and then have your Form 1248 filed with the IRS as an amended Form 4506 with the correct taxpayer information.

Q. Is there any other way that I can know if my return should have been filed by the date provided on the Form 4506 with the Department of Labor?

A. Yes, you can file electronically using Form 8683 or Form 5329 with the IRS; or you can file a paper Form 5329 with the IRS and the Department of Labor if you wish to have a copy of the return prepared by the IRS on your behalf.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here