Award-winning PDF software

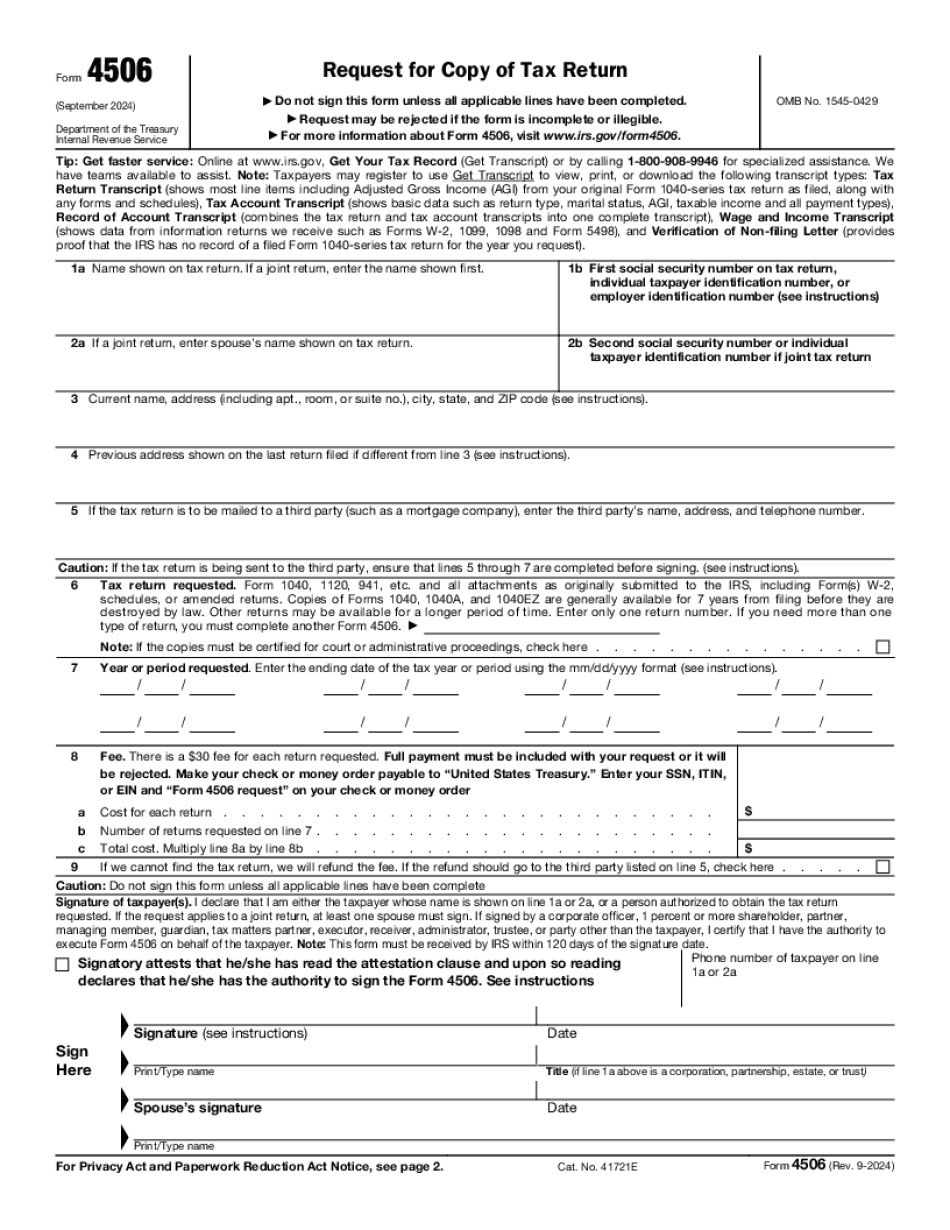

Form 4506 Arlington Texas: What You Should Know

Establish a statewide vision for a future health care system that ensures State, local, and private entities work together to achieve, through innovative procedures and systems, sustainable improvements in physical and mental health, health outcomes for Texans. Develop a vision for the Texas Health Care System and Statewide health care workforce to meet our shared goals. This is another example of IRS trying to control our political discourse. Not good news for Americans. In a post, Texas A&M University Professor Eric Racer wrote A Tax Scam for the Rich: IRS' “Form 4506-T” Will Soon Be Required to Be Filing, “As I Have Been Expecting For Some Time”. Racer says that “The IRS has released a list of all the required forms for the 2025 tax year that is now due April 17th. The latest version lists form #4506-TN, which I expect to have to complete.” Racer points out that in 2017, Congress mandated that, by April 16th, every individual filing jointly in the US had to complete a Form 4506-TN, or request a non-filing extension, or be penalized with a 30% tax penalty on income below 120,000. So the same IRS that tried to control political rhetoric is now demanding Americans file Form 4506, or else face 30% tax penalties? Racer goes on to criticize the move for “creating problems and for not doing anything to reduce the number of taxpayers filing forms with tax-exempt status, but there is no problem, as the “filer” will not be charged with a violation of the federal tax laws, even though the “return” is really only a document containing “certified” income with a maximum “taxable income” at the maximum income tax rate for that income bracket.” So if an American pays 200,000 in taxes over a 30-year period, and the maximum amount of return filed for this income, then he or she will be subject to a penalty 180,000. The problem with that is that some may do nothing, but most certainly won't file a return. The problem is even worse for the wealthy: if the income was below the annual earnings thresholds, the amount of taxes will not be included in the return being filed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506 Arlington Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506 Arlington Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506 Arlington Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506 Arlington Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.