Award-winning PDF software

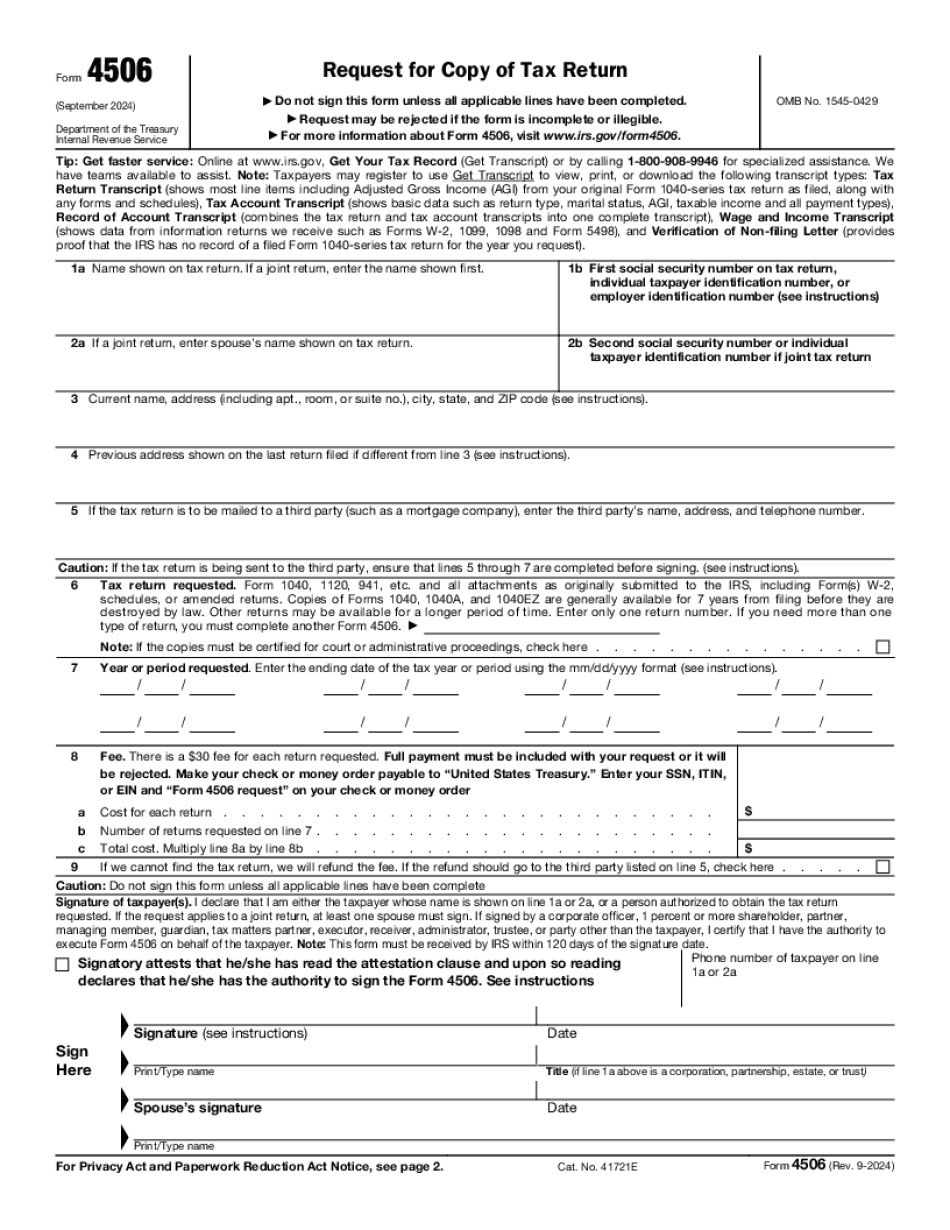

Killeen Texas Form 4506: What You Should Know

Internal Revenue Service Form 4506-F for Failure of Mayor to File a Federal Return Form 4506-F must be filled out completely and notarized under penalties of perjury. If the form is not completed, it cannot be relied upon. Form 4506-F should only be submitted and accepted by an IRS Field Offices, who are responsible for processing and paying Form 4506. Form 8286 for Failure to File a New Individual Tax Return If you have questions regarding this item, please contact the appropriate IRS Field Office. For additional information, read the Form 8286 Frequently Asked Questions page on this website. For any questions, contact: Internal Revenue Service Central Processing Office P.O. Box 181781 Kansas City, MO 64 Toll free: FAX: Form 828, Request for Duplicate Tax Return, from County The form is available from each county. New Jersey County Name (optional) (Enter county name) New Brunswick Camden Bradbury Hamilton Gloucester Hunter don Jersey City Middlesex Monmouth Ocean Ora dell Passaic Township Red Bank Salem Sussex Trenton Union Warren City, State, and Zip Code of the Applicant New Jersey, County New York City, State, Zip Code The Applicant's Name Address on the Tax Return for 2025 or 2014 Date the Tax Return was Received Type of Return You will have three choices on Form 8286. You will be required to complete and submit: · Form 8539, Application for Unemployment Tax Credit (Form 941), which the IRS will check for eligibility and for any current and/or past state unemployment taxes owed. If you filed a previous federal return, you must also pay tax for the current year. · Form 2848, Application in Lieu of Claim for Refund of Overpaid Unemployment Insurance Tax; · Social Security Number; · Signature (you must sign it, even if you are not required to do so for the other two choices in Form 8286.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Killeen Texas Form 4506, keep away from glitches and furnish it inside a timely method:

How to complete a Killeen Texas Form 4506?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Killeen Texas Form 4506 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Killeen Texas Form 4506 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.